Companies Must be Aware of the Financial Impact of Climate-Related Risk, Says ACCA

ACCA (the Association of Chartered Certified Accountants) has welcomed the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) as an important step towards the better allocation of capital, by incorporating the effect of climate change in investment decisions.

Yen-pei Chen, subject manager – corporate reporting at ACCA said:

‘The four thematic areas of the TCFD’s recommendations – governance, strategy, risk management and metrics and targets – provide a useful framework for disclosure.

‘The detailed implementation guidance in the annex will be particularly helpful for companies preparing to report under the EU’s Directive on the disclosure of non-financial and diversity information.

‘Climate-related disclosures, in our view, will be best integrated into the reporting of the impact of other material factors within the four thematic areas.’

ACCA also welcomed the inclusion of references to the financial impact of climate-related risk, and the ensuing recommendation that this be reflected in companies’ financial statements.

‘In particular, climate-related risks could affect the carrying value of assets and goodwill, and in some cases the going concern status of the business,’ added Ms Chen.

‘Accounting standard setters such as the IASB should be giving greater priority to closing the long-standing gap that exists in reporting the effect of pollutant pricing or emissions trading systems.’

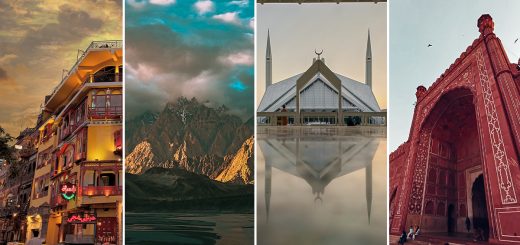

‘Pakistan has always faced extreme climate conditions, but now more than ever before climate or rather managing climate and its connected maladies is posing a threat that’s greater than global terrorism. Water scarcity for example threatens not only human lives but increasingly is being ignored by business processes. A lot of the environmental, social and governance costs needed for managing climate change are “off balance sheet”. This cannot remain the status quo. With game changing strategic investments like CPEC around the corner the cost to Pakistan of not investing in ESG in the short medium and long term may be a price too great.’ said Arif Masud Mirza, ACCA’s Regional Head of Policy – MENASA.

Professional accountants play an important role in helping companies to manage and report climate-related risks more effectively. This is particularly clear in light of this week’s EU adoption of non-binding guidelines for non-financial information reporting, which is another example of the global momentum towards better-informed capital markets and companies fit for the challenges of today’s world.

ACCA is committed to educating the professional accountants of the future, giving them the skills they need to respond to this wider set of challenges, and contribute to a more sustainable future for businesses and our planet.